Authorities detained 14 people who cheated with online loan business using loan applications such as Morning Cash, Smile Loan, Cash Loop, Wa Wallet, PK Cash and AJ Cash and seized 133 laptops, 10 mobile phones and a vehicle.

They provided loans to people online at high interest rates and made to repay back loans as soon as possible and if the loans and interest are not paid back, they demanded money by threatening and using technology to obtain the information when the users applied for the loan, according to the complaints of defrauded victims and other information. The Bureau of Special Investigation (BSI) and the Criminal Investigational Department (CID) are working together to identify and take action, announced the State Administration Council (SAC).

In doing so, after learning that Ma Su Yee Nwe, who lived at No.458/A, Natmauk Road, Ward 9, Hlaingthayar (Western) Township, Yangon Region, was calling people and threatening them to pay back money regarding online loan issues and the necessary investigations were carried out on her on February 15. Authorities found out that she was employed an online loan service company called Mashala Tech Co., Ltd., which was found on the TikTok social networking site around January 2023. It is learned that she joined Team-A as a loan collector with a monthly salary of 320,000 kyats, it said.

According to the testimony of Ma Su Yee Nwe, the authorities detained 13 people including Ma Myat Sanda Win aka Sandar, employed at Masala Tech Co., Ltd and seized 133 laptops, 10 mobile phones and a vehicle.

The Mashala Tech Co., Ltd. is registered under the sole name of U Zeya Min, but the person actually doing the business is a Chinese citizen, Mr. Yu Linfeng aka Willian and the company is opened at MMG Tower on Kannar Road, Botahtaung Township. Mr. Yu Linfeng has not returned to Myanmar since leaving Cambodia on January 5, according to the SAC.

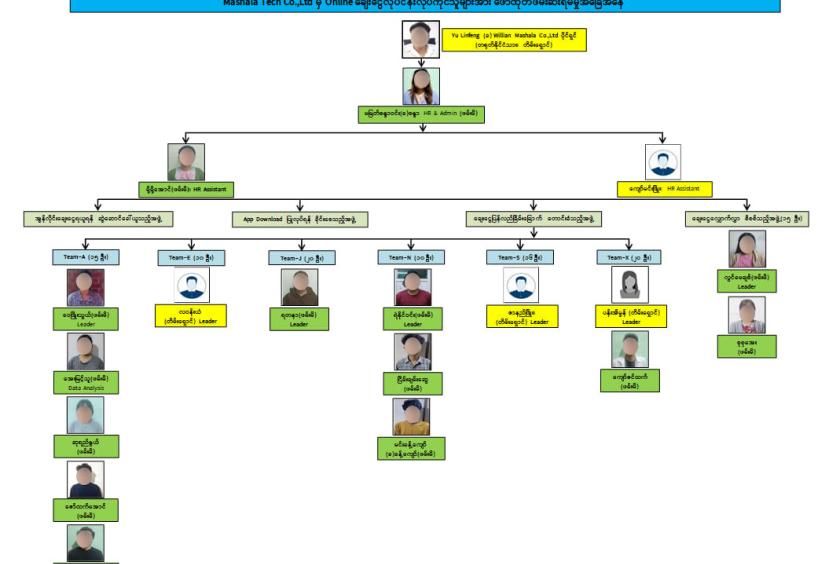

The company is supervised by Ma Myat Sanda Win, an HR employee and Ma Moh Moh Aung, Assistant HR employee, who were arrested, and Kyaw Min Phyo, who is still at large and they are led by Mr. Yu Linfeng. Under their supervision, there were four groups: a group that attracts people to get online loans, a group that asked to download the loan application, a group that verified the loan application and a group that threatened the users to pay back the money, announced the SAC.

The four groups are organized with 91 people including people who are still at large.

The authorities have opened a case against Mr. Yu Linfeng (b) Willian, who was left to be arrested in the process, and Myat Sanda Win aka Sanda, Ma Aye Myint Thu aka Zu Zu Ko, Su Yee Nwe, Ma Wai Phyo Thwe aka Ma Wai, Min Khant Kyaw, Zaw Htet Aung, Kyaw Zin Htet, Ma Yadanar, Ma Lwin May Chit, Ye Naing Win, Ma Moh Moh Aung, Min Khant Kyaw aka Khant Kyaw, Nyein Chan Swe and Ma Su Su Aye and is continuing to arrest people who are involved in the process in accordance with the law, it said.

Loan applications such as Morning Cash, Smile Loan, Cash Loop, WA Wallet, PK Cash, AJ Cash, Morning Wallet, Sky Cash, Happy Cash, Sun Bag, Zuri Loan and Quick Cash are being advertised by Mashala Tech Co., Ltd. in the Wave Money Application so that the public can see them. For those who want to get a loan, after downloading the application and installing it on their phone, they have to submit their name, photo, phone number, KBZ Pay and Wave Pay accounts, front and back photos of National Registration card and Gmail account in the loan form to register. If the borrower grants the permission access on the phone and allows it, the application illegally obtains all the phone contacts connected to the Gmail account.

After doing that, 30 percent of the amount to be borrowed with loans from a minimum of 30,000 kyats to a maximum of 300,000 kyats will be transferred via KBZ Pay and Wave Pay account with an interest deduction. After that, the loan money will be made to repay within a week, and the company employees will call the borrowers on the phone or make to pay the loan via Viber or SMS. They rang those who do not repay the loan and contact persons on the phone and swore and threatened them in addition to making threats on social networking sites to cause humiliation.