Pact Global Microfinance Fund (PGMF), the largest microfinance provider in Myanmar, has announced its closure after forgiving more than US$156 million of the outstanding debts of 890,000 borrowers.

In the announcement, PGMF said it would cease operating in Myanmar after June 30.

“We have sadly concluded that we can no longer operate in the country despite working diligently over the last two years to persuade the government in Myanmar to allow the organization to continue serving hundreds of thousands of borrowers and savers,” said Ellen Varney, Chair of the Board for PGMF.

The government refused to give its approval for PGMF to register as a commercial entity which could continue to provide microfinance loans unless PGMF agreed to share the organization’s profits and agreed that all its assets go to the government in the future, the announcement said.

“On behalf of the leadership, we want to thank our clients, partners, lenders, and hard-working PGMF family of employees for their support. We stand ready to reenter the space when conditions permit,” said Fahmid Bhuiya, President & Chief Operating Officer of PGMF.

In recognition of the hard work and dedication of the organization’s staff, management has pre-paid salary and benefits and a bonus to its employees. It has also met all its obligations and paid for any accrued leave not taken and for any benefits owed, the announcement added.

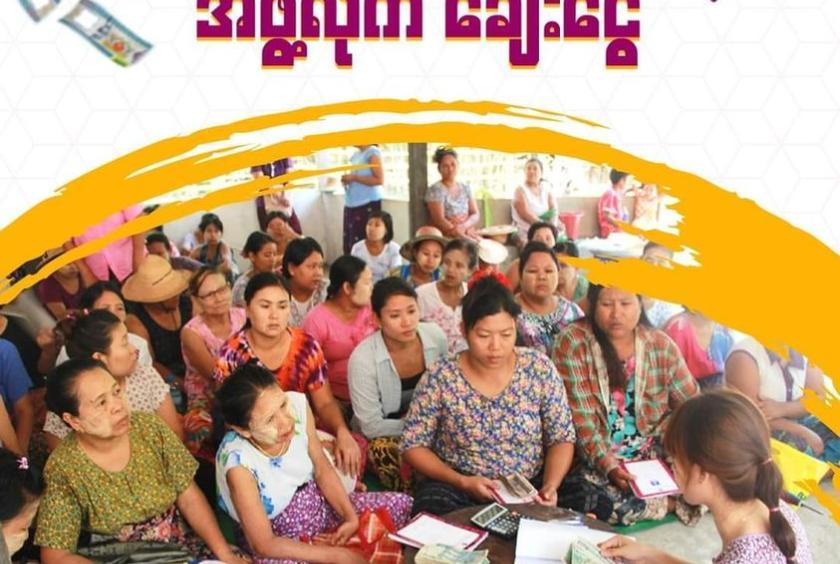

PGMF has served nearly 15,000 villages and 2.3 million clients over its 25 years of service to the people of Myanmar, 99 percent of whom are women, reaching nearly 1 in 10 households in Myanmar.

Pact Myanmar has also announced that PGMF’s announcement to cease operations in Myanmar does not have an impact on Pact Myanmar’s current program operations. PGMF and Pact Myanmar are legally separate entities.