Due to the lack of control over the imports of medicines that could be produced in the country and similar medicines, local pharmaceuticals are facing difficulties, said Dr. Aung Zaw, Vice-President of Myanmar Medicine and Medical Equipment Entrepreneurs Association.

“The problem is that there is no policy of purchasing local-made medicines on a priority basis. Like other countries, there is no purchase of local-made medicines only when the tender prices are same or the prices are higher than the designated ones. Local-made medicine manufacturing industries are facing many difficulties as there is no control over or suspension of the licences of foreign-made medicines,” he added.

The three to five per cent custom duty is collected on imported medicine raw materials, reagent used in laboratories and other medicine packaging. Some imported finished medicines get tax exemptions. Local-made medicines are not in a position to compete with imported medicines in term of production and market as the 1.5-per-cent tax is collected on some medicines.

In a bid to encourage local medicine production in other countries, businesses in the medicine industries get tax exemptions for imports of raw materials while taxes on imported finished medicines are increased. Myanmar should decrease tax rates for imported other raw materials including medicine raw materials and increase tax rates for imported finished medicines, he continued.

There are five state-owned medicine plants and seven private-owned medicine plants. These plants are producing 362 medicines.

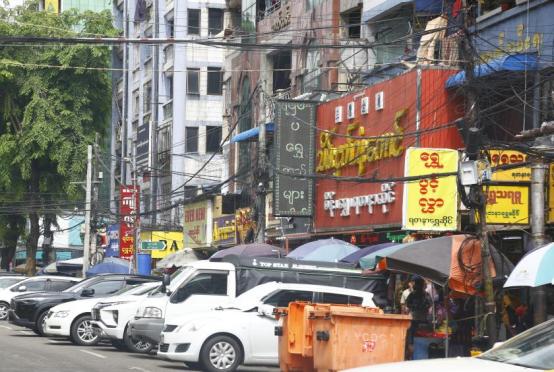

Most of illegal-imported medicines are from medicine companies based in Thailand, China and India, according to Food and Drug Administration Department in Myanmar.